People usually associate multi-digit loans with traditional banks. While these financial institutions have for centuries been the top-of-mind fund source for those needing access to huge sums of cash, there’s a lesser-known alternative that might just be your next stop for a loan: a pawnshop. Specifically, M Lhuillier and the ML Home Loan which promises a quick and hassle-free loaning experience for home or landowners looking to pawn their property’s title and use it as loan collateral. You may be thinking “What are some of the advantages of going this unconventional route?” and “Isn’t that a risky proposition?” We’re glad you asked. Read on to find out why opting for the ML Home Loan might just be the smartest move you’ll make towards your financial future.

The ML Home Loan is much faster from application to release

One of the primary advantages of the ML Home Loan is the relatively quick access to much-needed funds. A traditional bank’s lending process often involves piles of paperwork (such as income requirements) and lengthy processing times, making the whole process difficult and needlessly complicated. M Lhuillier has committed itself to simplicity and flexibility, ensuring that the ML Home Loan process is something you won’t be intimidated by.

M Lhuillier makes the loaning process pain-free by only requiring a few essential documents from loan applicants: (1) Original Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT); (2) Tax Declaration or Tax Clearance; (3) Sketch Plan; and (4) an appraisal fee starting at just PHP 4,500. Submit these requirements at your nearest M Lhuillier branch, fill up the application form, and wait for M Lhuillier’s call for your loan approval. Afterwards, you only have to endorse the property’s insurance policy in favor of M Lhuillier and then get your money at your branch of application. It is that simple!

This streamlined application process ensures that you spend less time navigating paperwork and more time getting your funds to where it needs to go—especially important if you are faced with time-sensitive concerns such as emergency medical expenses, sudden home repair needs, or critical additional capital requirements for your business.

The ML Home Loan is available to all

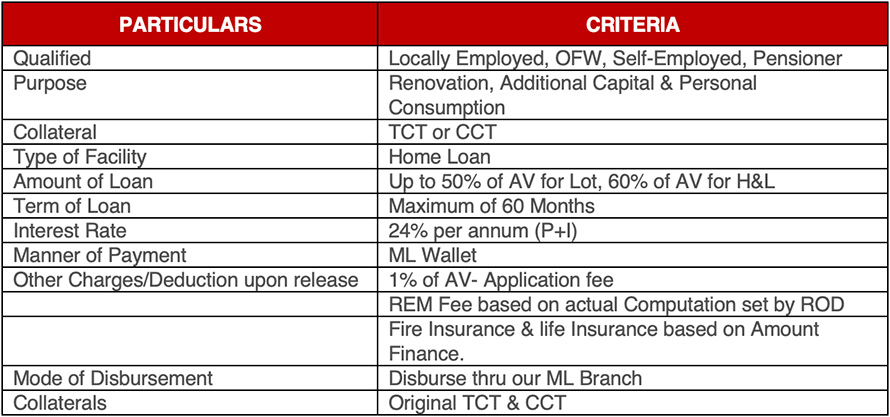

The ML Home Loan advantage extends beyond convenience. Unlike traditional banks which require good credit history and steady income sources, the ML Home Loan requires no such burden. This makes it particularly useful to individuals with less-than-perfect credit standing or irregular income streams. It’s a refreshing departure from the rigid criteria imposed by traditional lenders, opening doors for those who may otherwise feel excluded from multi-digit loans.

The ML Home Loan ensures your home remains yours throughout the loan period

One concern often raised about pawning a property’s title is the risk of losing ownership. This is not something you need to be worried with through the ML Home Loan. Unlike traditional pawned items, such as electronics, jewelry, and other valuables, your home remains yours throughout the loan period. This means you can access the funds you need while still being able to live in your home. It’s a win-win situation that allows you to leverage your home’s value without sacrificing comfort, ownership, or stability.

The ML Home Loan features friendly and transparent pricing

M Lhuillier ensures that the ML Home Loan process involves no hidden fees and no convoluted jargon—just clear and straightforward terms that give you the confidence and peace of mind you need to pawn your property’s title.

You have the flexibility to borrow up to 50% of the appraised value for lots and 60% for house and lots, with M Lhuillier’s industry-leading appraisal rates allowing you to get the most bang for your buck. The repayment period spans a maximum of five years, ensuring that your monthly payments are only as long as you are comfortable with. Plus, you can conveniently process payments without worrying about the 5% late penalty fee by using the ML Wallet app or by visiting your nearest M Lhuillier branch.

Better yet, if ever you decide to prematurely end your loan, you only have to pay a mere 3% pre-termination fee based on the outstanding balance in order for you to be free from your obligations.

Customer-first service

M Lhuillier has over 30 years of experience in ensuring customer satisfaction. Its team of trained staff are dedicated to happily guiding you throughout every step of the loan process, from your initial inquiry all the way to your last payment and everything in between. Whether you are regularly employed, self-employed, freelancing, an Overseas Filipino Worker (OFW), or a pensioner, M Lhuillier’s is committed to being a reliable partner in your financial journey.

Moreover, M Lhuillier has over 3,000 branches across the National Capital Region, Luzon, Visayas, and Mindanao which provides the ML Home Loan service, ensuring that your needed funds are always easily within reach.

Guidelines and Parameters

Puwede kang magloan with M Lhuillier!

Choosing M Lhuillier for your funds means you are getting a flexible, hassle-free, and financially-responsible loaning experience. Explore the M Lhuillier advantage and let M Lhuillier be your trusted partner in meeting your financial needs. Your journey begins at your nearest M Lhuillier branch!

For more information on ML Home Loan, visit https://mlhuillier.com/home-loan/

To learn more about M Lhuillier’s products and services, visit https://mlhuillier.com/

![]()