Amid reports that cash is still king when it comes to the preferred payment method for online shopping, one company from a related industry is seeing a more neck-and-neck comparison among its customers.

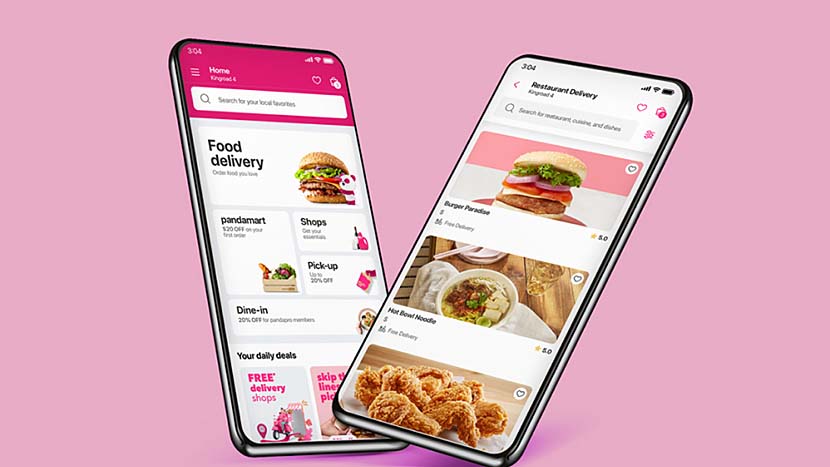

Online food and grocery delivery platform foodpanda has observed a rapidly increasing number of their app users embracing digital payment methods, with their customer base now split between cashless and cash-on-delivery payments.

The actual results from foodpanda’s records are mirrored by a survey done by foodpanda’s Berlin-based parent company Delivery Hero. According to their survey on Filipinos’ payment method preferences, 51% of consumers prefer paying with cash, while the other half prefers various digital payment methods, with 27% using a mobile wallet app, 17% using a debit or credit card, and the remaining 4% using other digital payment methods.

An underlying reason for those who continue to use COD is their habit, the ability to control spending, and a sense of security. Conversely, those who opt for online payment methods primarily cite convenience as their top reason for using this payment method.

Future-proofing payment systems

Promoting digital payments aligns with the Bangko Sentral ng Pilipinas’ efforts to enhance financial inclusion in the country. Their Digital Transformation Roadmap 2020-2023 aims to strengthen the country’s digital payment ecosystem, with the goal of digital payments accounting for 50% of all retail transactions.

According to foodpanda Philippines Chief Executive Officer (CEO) Daniel Marogy, to encourage the widespread adoption of digital payments and establish a secure and efficient digital financing platform, foodpanda has seamlessly integrated with trustworthy payment gateways.

For a simplified and faster checkout process, foodpanda introduced their e-wallet service pandapay that enables customers to store credits within the wallet.

Marogy also shared that foodpanda has been providing incentives such as cashback, fast refunds and instant and secure transactions, to entice more customers to use pandapay.

It emphasized that beyond their app users, this digital-first approach is holistic, encompassing their partner vendors and delivery partners.

The Future of Payments: A Hybrid Model

Much like the marriage of online and offline commerce, the future of the payment landscape envisions cash and digital payments seamlessly complementing each other.

Looking ahead, the foodpanda PH Chief believes that they are on the right track by leveraging both payment methods. “Cash and digital payments will coexist for some time to come. The economy is still predominantly cash so that will reflect in our customers’ payment choices on the platform. By offering both options for our app users, we provide flexibility to cater to diverse customer needs. Our goal is not to replace traditional methods with digital alternatives, but rather to give customers the option to freely select their preferred mode of payment.”

Nonetheless, he reassured foodpanda’s commitment to ensuring that secure and convenient payment avenues remain at the forefront of their mission. Our core mission is to make every transaction secure and simple, whether a customer chooses cash or digital payments for their food and grocery needs.”

![]()