Covid 19 is still floating around, there is global political and economic tensions amid worsening climate change, and national elections continue to divide the populace.

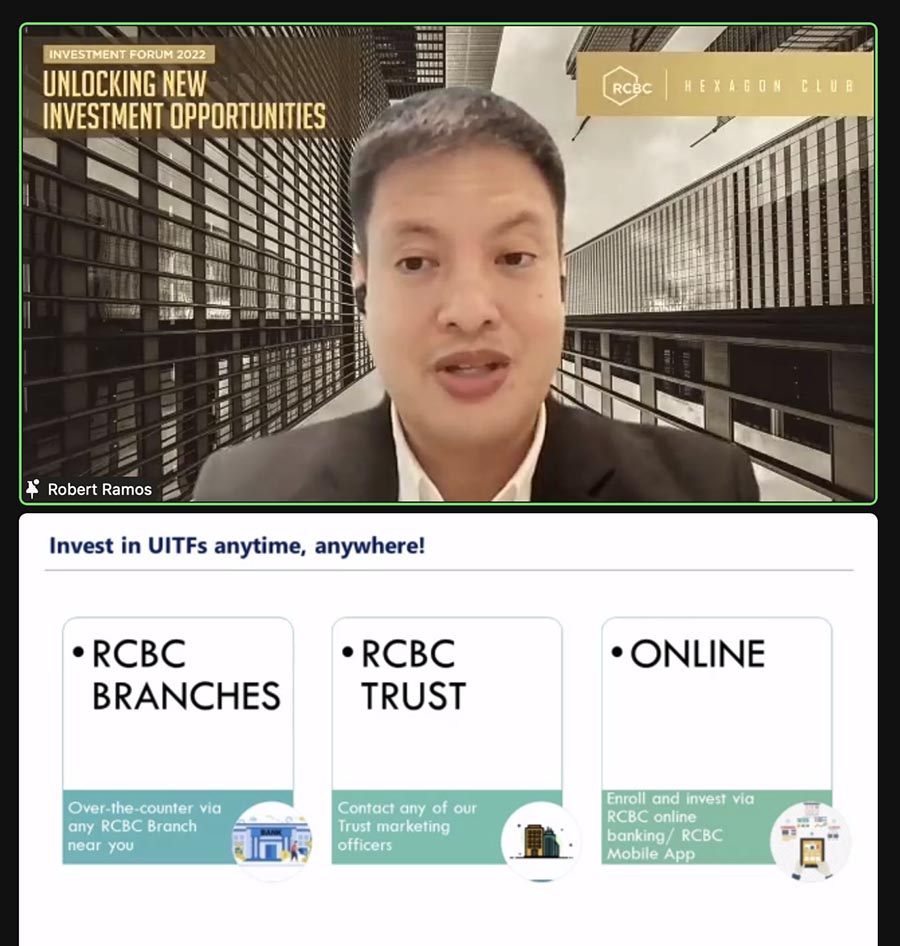

But banking experts, during the RCBC Hexagon Club Investment Forum, were all on the same page — it is always a good time to invest even in times of uncertainty.

Invest anytime, look for opportunities

For Robert Ramos, head of the Rizal Commercial Banking Corporation (RCBC) Trust and Investments Group, it is always a good time to invest, especially as a means to compensate yourself with financial security.

“It is always good to ‘pay yourself first’ and put aside funds for a rainy day. You never know when you might need these funds. A good example for this would be the establishment of an emergency fund that is invested in money markets or short term securities,” Ramos said.

Antonio Garcia, head of Retail Sales and Online Marketing at RCBC Securities, also said that while this is a tough time to be making investments, in the market, there are always opportunities to invest at reasonable valuations.

“A lot of it depends on one’s level of risk tolerance. If you can handle volatility, and we are seeing big swings almost on a daily basis, then you can take positions in specific stocks,” Garcia said.

“But any stock, whether defensive, dividend, blue chip, will still succumb to price drops if the market continues to drop. So my advice, if you’re buying, buy slowly and cautiously, as the market pulls back,” he added.

Hold, review, and re-invest

Say you have already tried investing, and numbers don’t look good today, Garcia’s advice is for you not to make any immediate decision and think things through.

“The best thing to do is review your investment/trade and see where it went wrong,” Garcia said. “Did you buy too early? Did you buy too much at one time? Always review and see how you can correct any mistakes you may have made with your investments”.

The faster you can analyze what went wrong with a trade/investment, Garcia said, the faster you will be on your way to making better decisions.

For Ramos, it’s also about looking at the assets you are investing in, adding that if the asset class you are holding depreciates in value, there are always two options.

First, if you see more value in the security and the asset depreciated only because of volatile market conditions, you may hold on for the meantime.

But, if the security does not provide further value then you should be willing to sell it immediately and move your funds to a more profitable investment.

Invest according to your needs

If you’re a new investor and you are not sure about where to put your money in times of uncertainty, Ramos said the best thing to do is invest according to your needs.

“Consider your objectives, your willingness to take on risk, your funding needs, your time horizon and your investment knowledge/experience,” Ramos said.

Garcia, on the other hand, said that new investors can easily invest in stocks with the help of RCBC Branch Relationship Managers or with the Sales team at RCBC Securities, and explain the process and the fundamentals of investing.

Get rid of the baggage

Remember that your ultimate goal is to achieve financial security. Ramos said that generally, it would be better to pay off your debt first before investing.

“The only time you should invest first is when the interest earned from your investment will generate more than the interest of your debt,” Ramos noted.

Garcia thinks so too, adding that if you’re holding extra cash in a time of uncertainty, then it’s best to hold that cash until clear signs emerge.

“Debt compounds and you don’t want to have that debt keep growing to the point that you find it unmanageable. If you have enough excess cash, clean out your debt. If you can’t clean it out, manage it so it doesn’t become a burden to you in the future,” Garcia said.

It all depends on you

Another thing to understand is that investing is not a linear process. It does not start and end in a specific timeframe.

For Ramos, the timing of your investment would depend on your outlet, objectives, and time horizon.

Long-term objectives, he said, generally require a long term horizon (i.e when you are preparing for your retirement), while saving for a vacation would have a shorter time frame.

“Investment horizons are specific to each person,” Garcia said. “There is no one strategy for this. What is your objective? What is your goal? What are your investment rules? And you should have your own rules. What is your risk tolerance? You need to take all of this into account before you make any investment”.

This recently held Investment forum is an exclusive event hosted by RCBC’s Hexagon Club where financial and industry experts have come together to provide an economic outlook as well as viable investment opportunities. Featured industry experts included guest speaker David Leechiu, CEO of Leechiu Property Consultants Inc., along with RCBC financial experts, Chief Economist, Mike Ricafort, Dr. Robert Ramos, head of Trust and Investments Group, and Antonio Garcia of RCBC Securities, Head of Retail and Online Marketing. Through this forum, RCBC is able to empower clients with relevant information they need to make informed decisions, not just with their investments, but with their respective businesses.

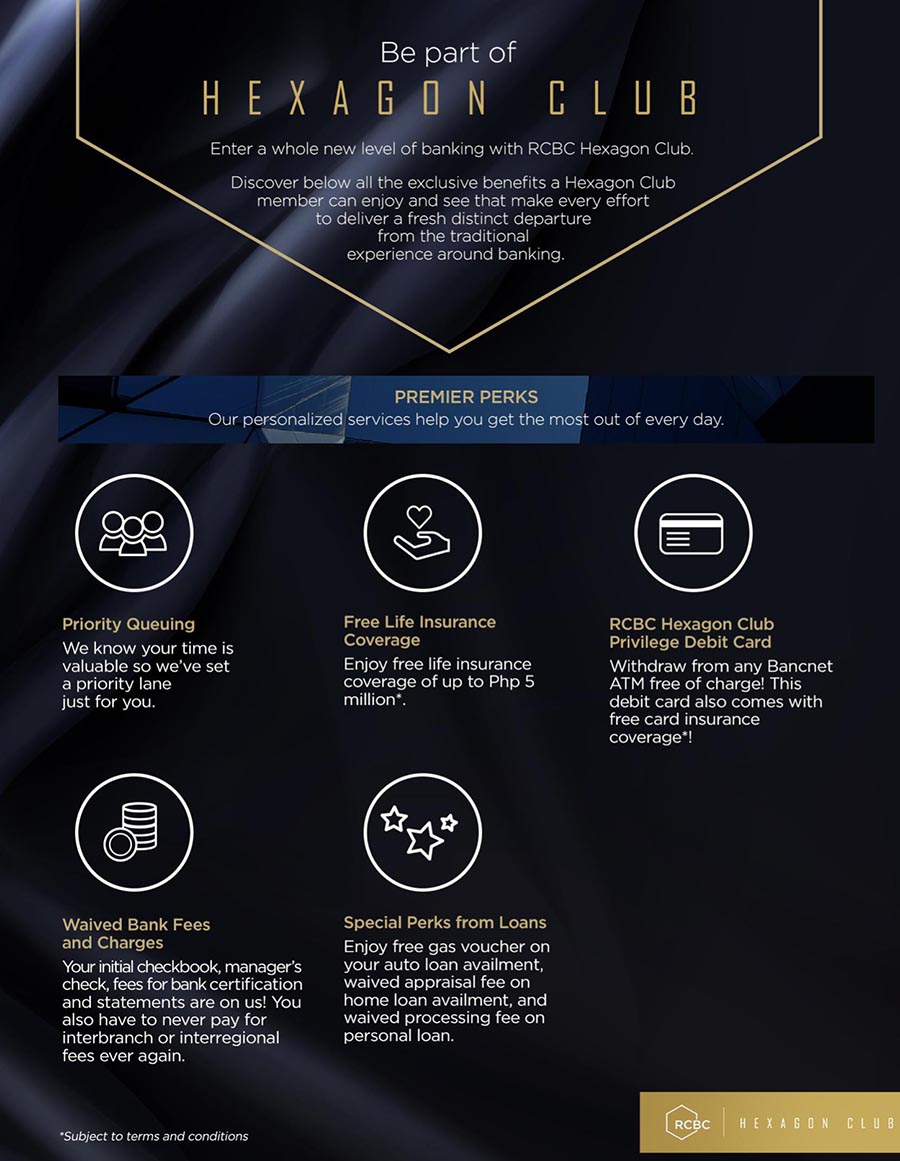

The Hexagon Club is the bank’s premier club that offers a premium banking experience, with exclusive perks and privileges. It provides its clients the flexibility and opportunity to maximize their funds potential depending on their financial objectives or priorities. To know more about RCBC’s Hexagon club, visit www.rcbc.com/hexagon-privilege.

![]()