Online payment gateway JazzyPay has teamed up with Union Bank of the Philippines (UnionBank), one of the largest banking institutions in the Philippines and the digital trailblazer in Asia Pacific, to provide cashless payment solutions for SMEs and local businesses. With the partnership, JazzyPay customers can now settle payments using their UnionBank accounts. In turn, UnionBank Online users can now pay for local and essential businesses registered with JazzyPay.

With Filipino consumers and businesses being more familiar with using e-payments and utilizing online banking services since the start of the series of lockdowns due to the COVID-19 pandemic, the digital payments space has been seeing increased growth. According to Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno, his personal goal of seeing half of the financial transactions in the country be settled electronically by 2023 may even be achieved sooner, as the pandemic has become a catalyst for the quick growth of digital finance in the Philippines.

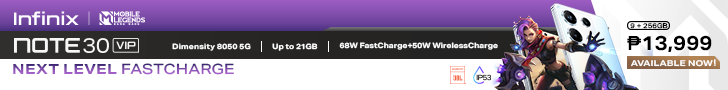

JazzyPay, an online payment gateway system that allows businesses of all types and sizes to accept cashless payments across credit and debit cards, e-wallets, online baking, and over-the-counter cash deposits, seeks to contribute to the acceleration of digital payments in the Philippines. Currently, onboarded merchants are able to accept payments through 27 payment methods, now including UnionBank.

Aside from being a unified online payment platform, JazzyPay also enables businesses to send online invoices to their customers without having to use third-party invoicing services. By offering these capabilities in a single platform, JazzyPay aims to empower even the smallest businesses to grow through an efficient and streamlined payment collection process.

Founders Joshua Marindo and Kathleen Acosta

Advertisement

The pandemic has undoubtedly sparked unprecedented global disruption, but UnionBank’s prudent use of technology is driving the bank to cope with the new normal. Since the lockdown in March, the Bank has seen a dramatic surge in online banking transactions through its UnionBank Online app.

According to UnionBank President and Chief Executive Officer Edwin Bautista, transactions done through the bank’s mobile app rose from 40,000 in January 2020 to nearly 1 million by December 2020. As a part of its “Tech up, Pilipinas” advocacy, UnionBank also recently launched its mobile banking app for SMEs, becoming the first SME-focused banking app in the Philippines, allowing for greater growth for smaller businesses in the country.

With its partnership with UnionBank, JazzyPay allows onboarded businesses to reach a wider audience and growth.

![]()