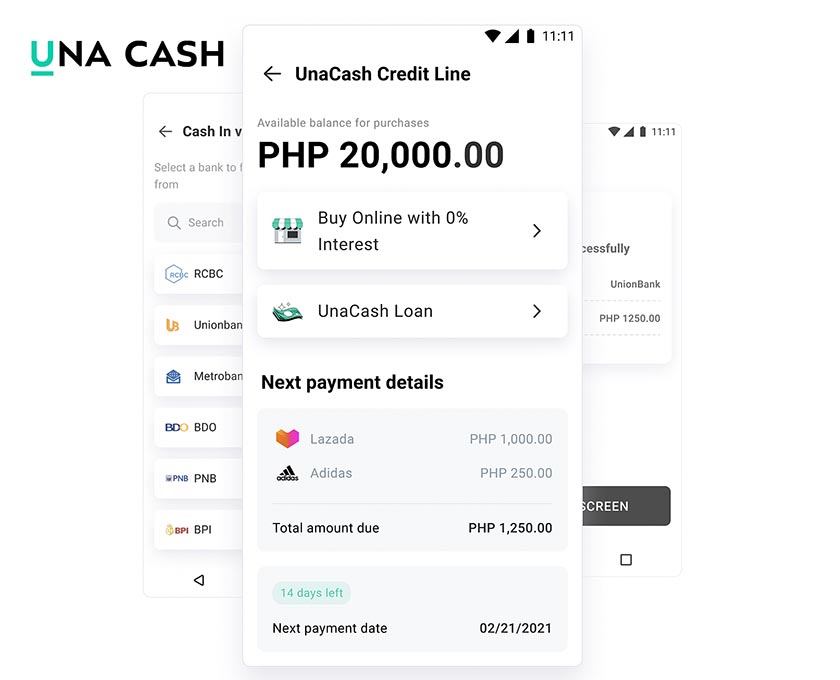

UnaCash, a people-centric installment solution, announces a significant upgrade to its services by offering point-of-sale (POS) loans to every Filipino. This gives customers further accessibility to financing options through in-store exposure.

UnaCash delivers its products and services through innovative installment solutions. With its Buy Now, Pay Later feature now able support its customers at the point-of-sale and allows the purchase of merchandise from its merchant partners, Filipinos are given a variety of lifestyle upgrades based on their respective interests and budgets, one transaction at a time.

The upgrade of this BNPL solution aims to address the evolving financial requirements and seeks to promote financial accessibility and stability to its consumers. UnaCash highlights its maximum loanable amount from Php3,000 to Php50,000 with the flexibility to extend its payment terms up to twelve months. With an interest rate that begins at 0% up to 10% max, the new update allows its customers to have access to lifestyle improvements without straining their finances.

“In line with the National Strategy for Financial Inclusion, UnaCash is proud to announce the newest upgrade of expanding our app services to now offer point-of-sale loans. This strategic approach reflects the company’s commitment to support the unbanked population, and give better access to financial services,” Aleksei Kosenko, the President and Chief Executive Officer of UnaCash, shares. “Credit accessibility remains a strong need in the Philippine market. With this in mind, we wish to present a convenient alternative to consumers and process in-store purchases through UnaCash, as easy as buying everyday items at a grocery store.”

In addition, UnaCash is launching its POS loans together with a variety of products from its merchant partners ranging from smartphones, laptops, computers, appliances, furniture, hardware. Highlighting its successful partnerships, this includes Laptop Factory, Faith Glorious Fit, Homeworks the Home Center Inc., Emcor, JTG Trading Inc., Save’n’earn, and Trendy Gadget. Its steady expansion will go as far as beyond the boundaries of Metro Manila, reaching as far as Cavite, Rizal, Cebu and Davao.

Alongside the convenience being offered to its consumers, partner merchants are offered multiple sales channels including via the UnaCash app platform, a unique QR Code for merchants for faster processing of in-app installment applications, and low and flexible merchant fees. UnaCash works closely with merchant partners and provides the technology, financing, and support needed to generate successful financing programs at the point of sale. The target is to create a platform to ensure that there are in-house processes that will support them in generating seamless and comprehensive sales performance.

![]()