2020 brought about disruptions across many industries, affecting business activities and leading to a global economic decline. According to the International Monetary Fund’s October 2020 growth projections, the -4.4 percent growth was expected to continue until the end of the year.

In the Philippines, the banking sector was not spared as the economy went into a recession by the second quarter of 2020. Specific segments of the sector’s market continue to be in increasingly vulnerable positions. Some customers face temporary financial strain. Individual and corporate borrowers may lack sufficient money. Those with special servicing needs, such as the elderly, require customized assistance, especially with the transition to digital banking. SME owners are focusing on keeping their business afloat by seeking efficient and accessible banking solutions.

![[Photo] UnionBank SME Business Banking (2)](https://www.megabites.com.ph/wp-content/uploads/2021/01/Photo-UnionBank-SME-Business-Banking-2.jpg)

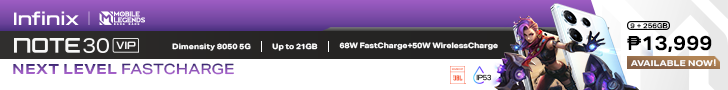

Union Bank of the Philippines, the first and leading digital bank to embrace technological innovations, unveiled its latest banking app tailored to the specific needs of a Micro, Small, and Medium Enterprise (MSME) introducing the UnionBank SME Business Banking App.

The latest SME Business Banking App by UnionBank is a one-stop-hub for all financial-related needs of any MSME or Negosyante. A full mobile app which clients or business owners can manage all their financial operations, improve and ease their ways of doing its business with just a few clicks. There is no fuss as the account will be available and ready to use within the same day and there is no need to fill out any forms or visit a branch.

The Unionbank SME Business Banking App can do the following full suite of innovative, convenient, and secure online bank transactions:

- Accounts Management

- Fund Transfers

- Bills Payments

- Mobile Check deposit

- US Dollar Transfers

- Swift International Bank Transactions

- Bank Information Automatically Listed

- Business Banking

- Keep track of Pesonet transactions

- Push Notifications Alerts

- Multiple Company Management (Manage multiple business with a single set of credentials)

The new app is fully secured as it uses multi-factor authentication and biometric security.

The Unionbank SME Business Banking App is now available and free download for iOS and Android.

To open your new business account go to this link.

“As the country continues to recover, Philippine SMEs need innovative, convenient, and secure banking solutions. Through our platform, we want to empower them to bank the way they want and according to what their business needs,” Jaypee Soliman, UnionBank Vice President for SME Platforms said.

UnionBank also offers other SME banking solutions including SeekCap and UnionBank GlobalLinker. Through SeekCap, business owners can apply for a loan fast and hassle-free. Through UnionBank GlobalLinker, a one-stop-hub digital platform, SMEs are able to manage their inventory and their respective teams, gain more knowledge about the local landscape, as well as expand their network all in one place.

![]()