Rizal Commercial Banking Corp. (RCBC) unveiled its physical-digital banking service called Moneybela Barangayan Banking part of the company’s continuous push to create an inclusive financial ecosystem in the country that caters to unbanked Filipinos in geographically isolated and disadvantaged areas.

The launch was held at the RCBC Plaza in Makati City together with top executives of RCBC, several key government agencies and special partners who witnessed to see the unveiling of the new banking service.

The Moneybela: Barangayan Banking is the Philippines” first mobile human-assisted remote banking service that will benefit 42,000 barangays nationwide with the opportunity to access financial services bundled with agent-assisted financial education.

Moneybela’s Banking Experience Support or Moneybela BES agent will go to communities where banks and other financial services are not commonly accessible. It was successfully piloted in Davao City in early September this year.

Equipped with RCBC’s ATM Go to enable cardless withdrawal for mobile point-of-sale terminals (mPOS)

Aside from going around various communities nationwide, the Moneybela electric tricycles will also provide financial literacy and agent banking services in public transport terminals, public markets, schools, barangay halls, and health centers to make it accessible to as many people as possible. Top RCBC ATM Go merchant partners in all 81 provinces in the country would serve as Moneybela BES agents that will visit hard-to-reach areas to enable more Filipinos to have access to financial services.

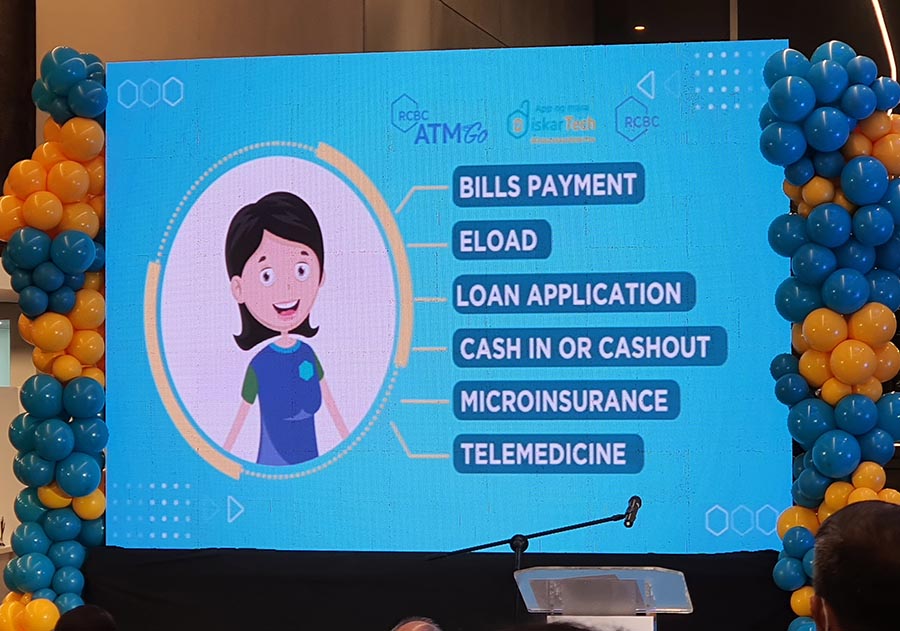

RCBC Executive Vice President and Chief Innovation and Inclusion Officer Lito Villanueva pointed out that Moneybela gives underserved and unbanked Filipinos access to the same financial services offered by physical banks, such as basic deposit account creation, bill payments, e-load, cash in or cash out, micro insurance, and telemedicine purchase via DiskarTech.

Meanwhile, RCBC President and CEO Eugene S. Acevedo highlighted the bank’s hope to contribute to a future where all Filipinos are financially included.

“A keyword in the name of our programmanibela, or the car’s steering wheel — serves as the main inspiration of RCBC’s innovations. Just like a manibela, we are optimistic to steer Filipinos’ lives toward a direction that is empowering, inclusive, and equal for all. Where are we heading? Towards a financially-inclusive Philippines, and as we take our journey, we need to make sure that no one is left behind.”

“This latest financial inclusion innovation supports RCBC’s thrust in promoting ESG or the environment, social, and governance within the framework of the United Nations Sustainable Development Goals,” Acevedo stressed.

Rallying their support for Moneybela are Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla and Secretary of Finance Benjamin Diokno who commended RCBC for “bringing more Filipinos into the fold” with its ground-breaking innovations for the country’s underserved sectors, and specifically lauded RCBC’s latest project that shows that the “future of banking requires human-centric and empathy-driven design.”

Meanwhile, Senator Mark Villar, Senate Committee Chairperson on Banks, Financial Institutions, and Currencies lauded RCBC’s latest innovation that furthers financial inclusion.

“I commend RCBC for this innovation to further promote inclusive digital finance. I believe that the banking sector plays a crucial role in attaining economic stability while financial inclusion is an essential foundation for sustainable and equitable national development,” said Senator Villar.

RCBC’s latest inclusive innovation perfectly aligns with the government’s whole-of-nation support for the National Strategy for Financial Inclusion and the realization of the Digital Payments Transformation Roadmap with its twin outcomes of converting at least 50 percent of retail financial transactions to digital and having 70 percent of adult Filipinos to have transactional accounts and be part of the formal financial system. Among its financial inclusion partners include the Departments of the Interior and Local Governments, Social Welfare and Development, Education, Information and Communications Technology, Trade and Industry, Liga ng Barangay, League of Provinces, Cities, and Municipalities including the Cooperative Development Authority and the National Youth Commission.

RCBC now has the most extensive reach covering 100 percent of the country’s 82 provinces with its close to 1,500 RCBC ATM Go terminals through more than 900 merchant partners nationwide.

![]()