Today, Visa held a virtual press conference to share its latest Consumer Payment Attitudes study to see its result in the new consumer behavior emerging in the Philippines as Filipinos are started to go on digital commerce platforms in making cashless payments amid this ongoing pandemic.

The brief virtual press conference was attended by Visa executives Dan Wolbeert, Country Manager for the Philippines & Guam and Grace Tan, Head of Corporatee Communication for Singapore, Malaysia and Philippines.

The study was conducted in August and September 2020 via an online questionnaire in selected key cities of Manila, Cebu, Cavite, Quezon, Laguna, Rizal, Bulacan, Davao del Sur, Pampanga, Negros Occidental, Batangas, Cagayan de Oro, Iloilo, Baguio, Davao etc.

Visa interviewed 1,014 Filipinos, ensuring a good mix of respondents across age, personal income levels, and key cities. The age demographics for its target respondents were as follows: 18 to 65 years old (Gen Z, Y, X, and Boomers), equal split of gender and working (full time or part time) or self-employed, and minimum monthly personal income of Php 12,000 (Mass and Affluent).

Here are the result of the survey according to Visa’s latest Consumer Payment Attitudes study:

- 52 per cent of Filipinos shopped online through apps and websites for the first time during the pandemic and 43 percent of them made their first online purchase using social media channels.

- Online shopping activity has also increased as close to nine in 10 Filipinos have increased their online shopping activities on websites or apps, whilst seven in 10 are shopping more on social media channels.

- More than half of the consumers are also more inclined to shop from large online marketplaces (53%) and home-based businesses (61%).

- More than 9 in 10 Filipinos used home delivery in the Philippines and 67 per cent of them increased their use of home delivery services during the pandemic.

- Pre-pandemic, more than seven out of 10 payments were made using cash compared to current usage of five out of 10. This trend of consumers carrying less cash is similar in other Southeast Asia countries.

- Filipinos cited using more contactless payments (73%), perceiving cash as unsafe because of the potential spread of infection (54%) and more places adopting digital payments (50%) as the top reasons for carrying less cash.

- Filipinos see bill payments (81%), grocery shopping (71%), and overseas travel (68%) as the top categories where they would likely go completely cashless in future.

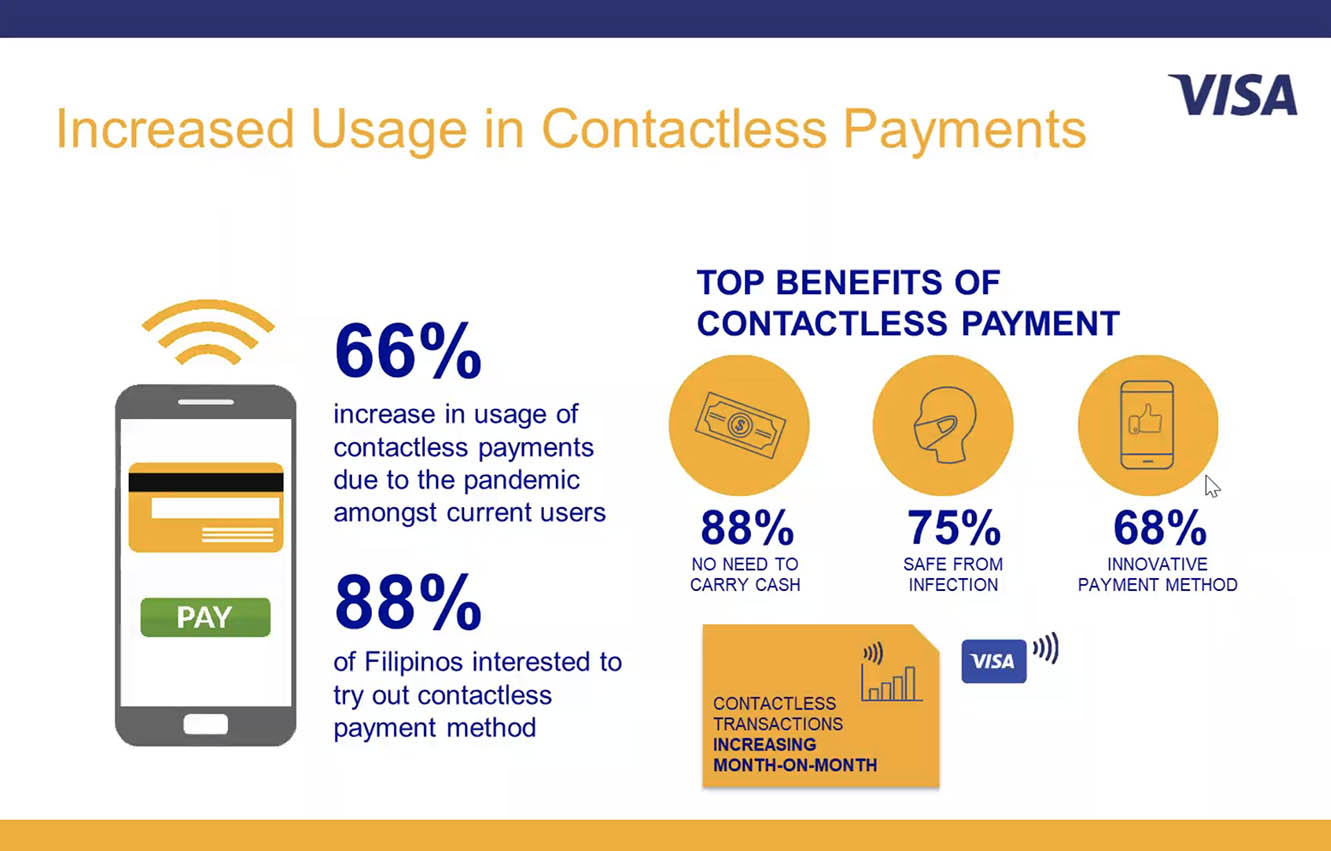

- It showed that contactless payments had 66 percent increase in usage amongst current users due to the pandemic.

- 88 per cent of Filipinos who had not used contactless payments stated interest in using this payment method in the future.

Advertisement

- Top benefits perceived by Filipinos for usage of contactless cards include not having to carry cash with them (88%), feeling safe from infection (75%) and being an innovative payment method (68%).

- In terms of contactless payments usage, Visa has seen an increase in all age groups, especially with Gen Z and Gen Y Filipinos driving that growth through eCommerce and home delivery transactions.

In the hope that the pandemic will soon be under control, consumers see travel as the top category that they most look forward to spending on when borders reopen. The study showed that 30 per cent of Filipinos look forward to domestic travel and 22 per cent would like to spend on international travel post COVID19.

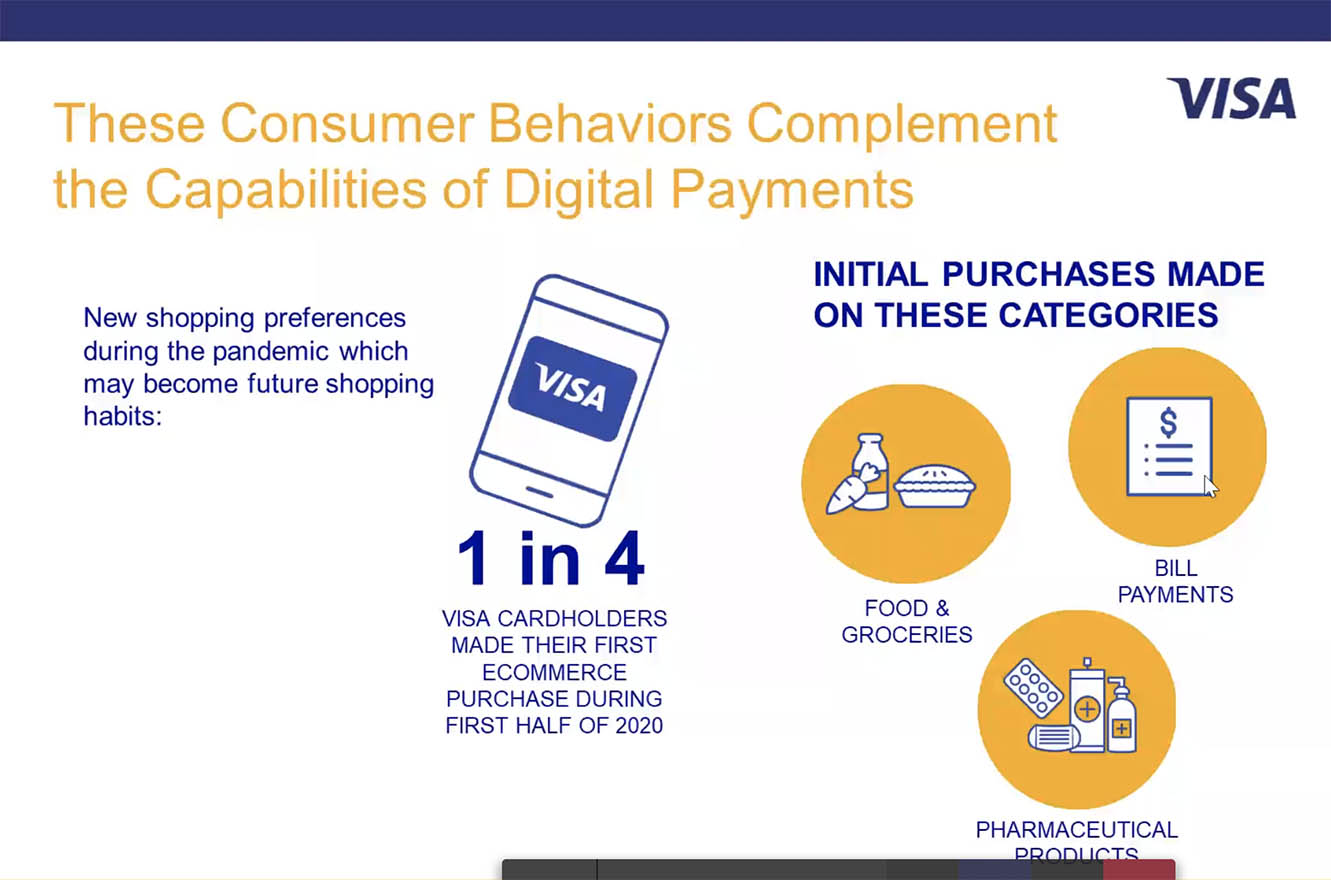

“The pandemic has transformed the way Filipinos shop and pay. Based on the latest highlights from our annual Visa Consumer Payment Attitudes study, we see adoption of new consumer behaviors including more Filipinos using digital commerce platforms and helping to accelerate the usage of digital payments in the country. Based on Visa’s data, we see double digit growth for eCommerce transactions for purchases on marketplaces and digital goods. In addition, one in four active Visa cardholders made their first eCommerce purchase during first half of last year. Categories that they made their initial purchases include food & groceries, bill payments and pharmaceutical products,” said Dan Wolbert.

![]()