Digital banking has now become commonplace for most of us who want the easy, hassle-free way of doing our online financial transactions. With challenges like having a busy schedule or the prospect of being stuck in long lines at the bank, digital banking has given us the freedom to take care of important financial tasks, from wherever we are and at any time we want, thanks to a few clicks of our mobile banking apps.

With so many digital banking options to choose from, why not choose one that puts you in control? Komo, EastWest’s digital banking service, offers you a suite of features to help you save and make the most out of your savings. From account opening to growing your savings, Komo has your best interests at heart.

Komo makes it easy & free for all

With Komo, there’s savings all around. You can save on costs as there are no maintaining and minimum account opening fees. You also save on time and energy – since it’s exclusively digital, there’s no need to visit a branch to open an account.

You also get a free VISA debit card when you open an account, allowing you to go cashless when you need to whether you’re in the Philippines or abroad! What’s better is that it also comes with free withdrawals! No need to worry about fees with unlimited withdrawals at EastWest ATMs and up to 4 free withdrawals per month for other BancNet ATMs in the country.

Even on transfers, you can also save on costs! Sending to another Komo customer? That’s instant and free of charge! Transfering to another bank? Enjoy the lowest rate in the market at only Php 8.00 per instaPay transfer.

Making the most out of your money

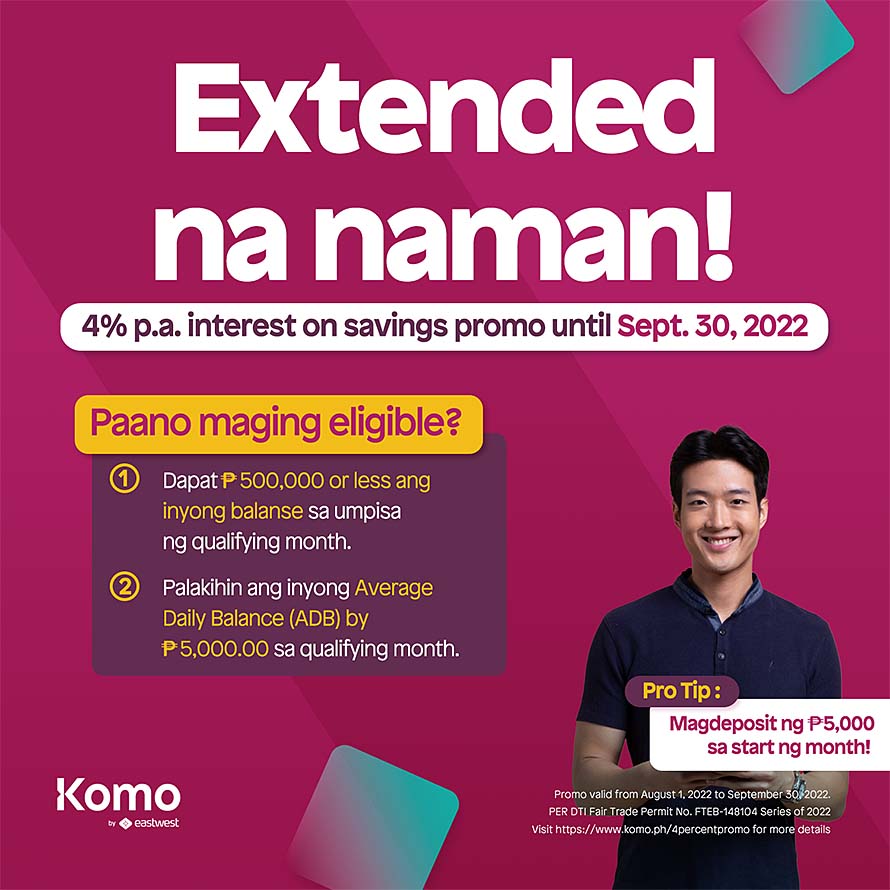

More than just the savings you can reap, Komo helps maximize your savings. Looking for higher interest? Komo offers their standard 2.5% interest rate p.a. on your savings paid out monthly — and a 4% promo rate until the end of the month – ensuring users grow their money faster than other traditional institutions.

Besides interest, you can utilize Komo’s Personal Finance tool! This money management feature allows customers to make better savings decisions by helping them set goals and budgets, track their progress, and gain insights from their expenses all free of charge, within the app.

Customers can also enjoy more flexible fund transfer limits: you can send up to Php500,000.00 per transaction to another Komo account. When sending to other banks, you can transfer up to Php50,000.00 per transaction via instaPay with a maximum of Php200,000.00 per beneficiary per day.

Among other things, Komo also offers Troo Flex, affordable and customizable insurance right at your fingertips. Take control of your protection by selecting the riders that fit your needs at your own budget. For as low as PHP 428 per year, you can already get 4-in-1 protection.

Get started in just 5 minutes!

Open an account from wherever you are, whenever you want in just a few minutes! All you need to do is to download the app for free on your iOS or Android device by clicking this link https://komo-ph.onelink.me/bFI9/017z3x5m, have 1 government-issued valid ID ready, and have a stable internet connection.

To top it all off, have peace of mind knowing your funds are safe and secure as Komo is backed by EastWest’s decades of banking experience, is PDIC insured for up to Php 500,000, and is regulated by the BSP your account’s safety is guaranteed. You can find out more about our services and features at www.komo.ph. It’s time to take control of your money and have the best of digital banking with Komo.

![]()