The Philippines is set to showcase its best financial technology (fintech) practices to an international audience and cement its global digital footprint in the five-day virtual World Fintech Festival (WFF) happenning on December 7-11. This year’s WFF shall spotlight key executives and decision-makers from different Asian nations as they discuss how they pilot fintech to produce societal impacts. Global tech legends like Bill Gates, Google CEO Sundar Pichai, and Microsoft CEO Satya Nadella will broadcast their talks to WFF participants in ten free sessions through YouTube and Facebook.

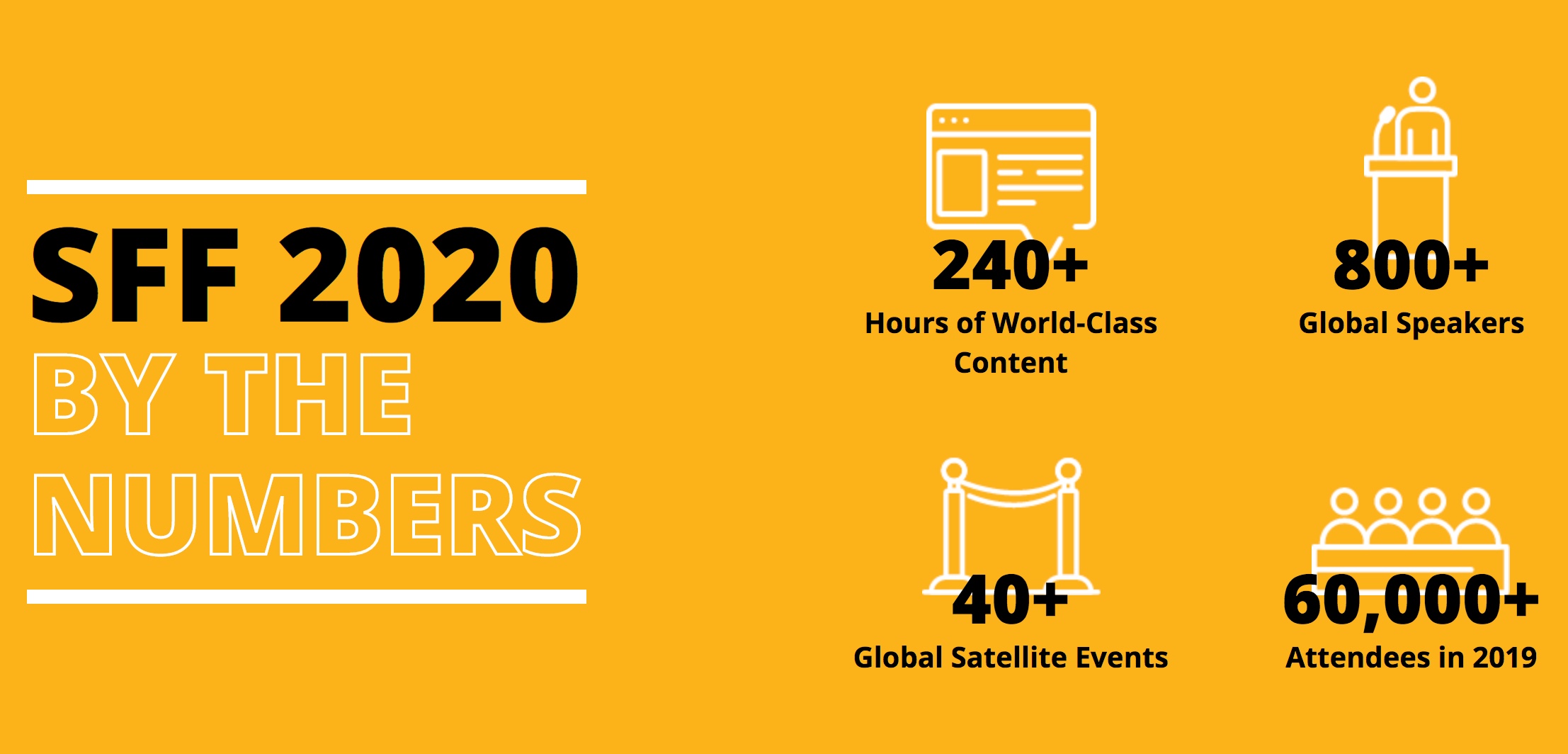

A first in the country, the WFF – Philippines is organized by GeiserMaclang Marketing Communications, Inc. (GMCI) in partnership with MAS and SingEx. It is expected to draw in the same crowds who attend the SFF, including business leaders and CEOs from 140 countries.

Previously presented as the Singapore Fintech Festival (SFF) in past years, the WFF-Philippines is co-presented by leading telecommunications company Globe. It is also intended to galvanize Philippine industries to accelerate their own adoption of fintech, be open to innovation, and invest in their workforce’s digital upskilling. It is designed to bring together the public and private sector to help build inclusive digital economies.

During the virtual presser on November 18, Sopnendu Mohanty, Chief Fintech Officer of the Monetary Authority of Singapore (MAS), remarked on the readiness of the nation’s fintech industry. He said, “The Philippines is the country that I will never ignore. You have a remarkable GDP and a fairly young demographic. The true test of a company’s strength comes from a crisis—and the businesses in the Philippines have truly demonstrated this.”

WFF-Philippines Convenor and GMCI’s Co-founder Amor Maclang, who moderated the panel discussion, says the event can amplify the Philippines as a tech hub attractive to global investors.

Industry leaders who will headline the WFF-Philippines were present during the virtual presser: Melchor Plabasan, Director, Bangko Sentral ng Pilipinas; Martha Sazon, President and CEO of Mynt and Chairman of the EMoney Association of the Philippines Inc.; Dr. Justo Ortiz, Chairman, UnionBank of the Philippines and President of the Fintech Philippines Association; Noel Bonoan, KPMG Vice Chairman and COO; and Atty. Mark Gorriceta, Managing Partner of Gorriceta Africa Cauton & Saavedra.

Bangko Sentral ng Pilipinas (BSP) has also paved the way for the country to be more open when it comes to seamless and contactless payment behaviors. Its data shows a surge in the use of internet banking, mobile apps, and services like Instapay and PesoNet during the pandemic.

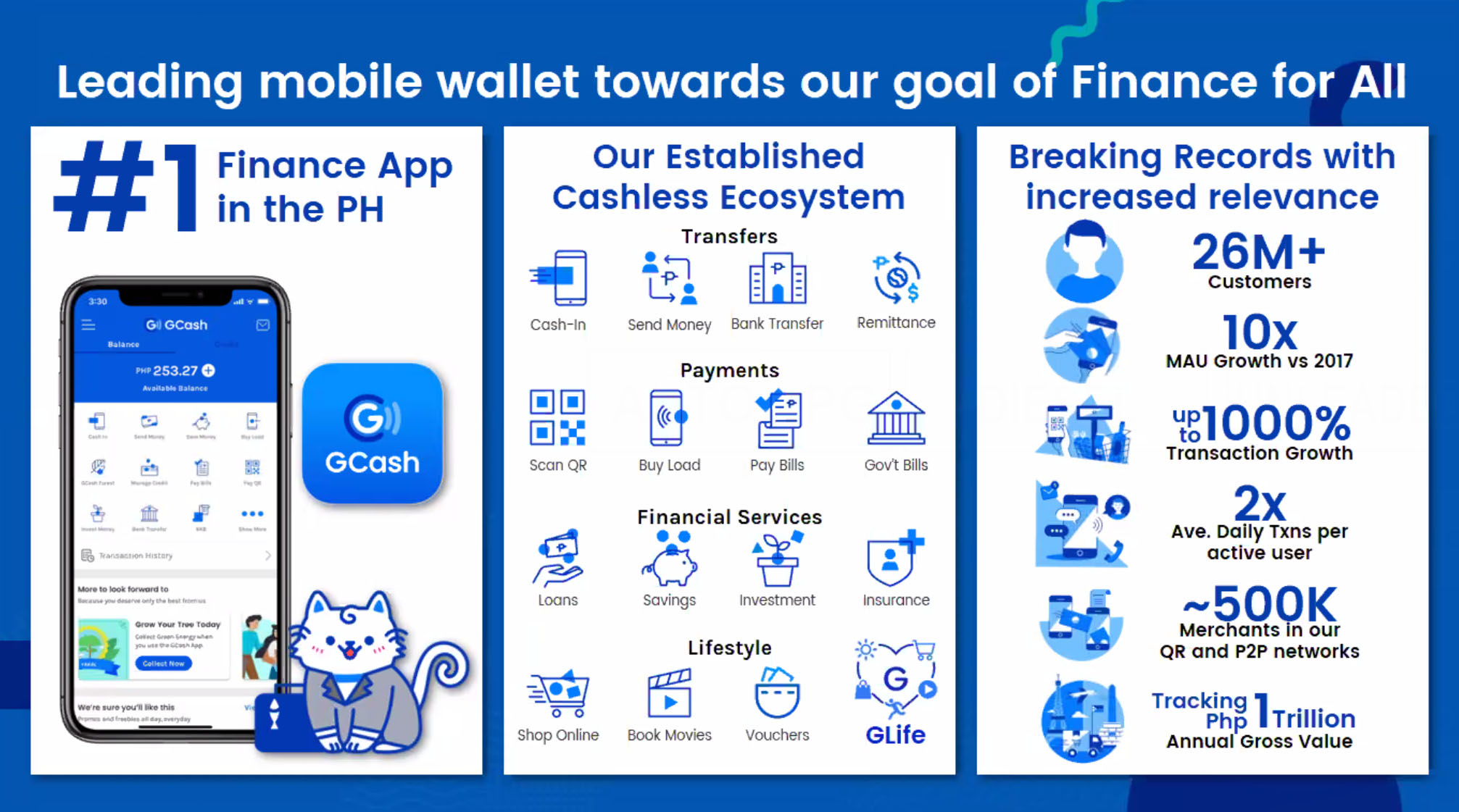

Martha Sazon, President and CEO of Mynt, which manages the country’s leading mobile wallet app GCash among its innovations, revealed one of the trends observed during the lockdown:

“It is the younger generation who is most aware of their financial stability within this time. These things have pushed us to provide savings, credit, and insurance, all within GCash. To date, we have gained 26 million GCash customers, which is ten times higher than our monthly users in 2017.”

Ms. Sazon, who is also Chairman of the EMoney Association of the Philippines, estimated that one trillion transactions will be made through GCash by the end of December.

Meanwhile, UnionBank of the Philippines, which pioneered digital banking, was able to accommodate the large spikes of consumer demand when the clamor for online transactions soared during the first few months of the COVID-19 crisis. Dr. Justo Ortiz, UnionBank Chairman, pointed out the future of money movements: “Financial transactions, embedded in actual live transactions people do day to day, are the ultimate end game. Whatever you do, whether you buy food, take a trip—we will embed it in financial transactions across the board.”

Auditing firm KPMG has leveraged on tech to redefine its business operations, services, and client management system. While Atty. Mark Gorriceta, Managing Partner of law firm Gorriceta Africa Cauton & Saavedra, affirmed that speedy, accountable action holds the keys to digital transformation.

Dr. Ortiz reiterated that in all great journeys of impact, making the difference at scale requires great effort and investment in human capital which is “the challenge of our generation. As the speed of innovation is accelerating, we need to double-time and intensify our efforts so nobody will be left behind,” he emphasized. “Learning, unlearning, and relearning will be a consistent process in our digital journey to become a robust and competitive digital society.”

The World Fintech Festival-Philippines agenda of speakers will span the length of the five-day global program which will run from December 7-11. For more information and to register for the event, click here: https://www.fintechfestival.sg/register-now.

![]()